Programs dedicated to alleviating child poverty have been shown to generate powerful social and economic benefits - in educational performance, income, and health outcomes - over a lifetime. Take a look at this important perspective from Faculty Director Hilary Hoynes and Rita Hamad in The Hill.

Evaluating the Impact of Urban Transit Infrastructure: Evidence from Bogotá

Procurement & Infrastructure Costs

Event Recordings: 2023 Place-Based Policy Convening

Event recordings from the 2023 Convening on Regional Inequality & Place-Based Policy.

Political Preferences and the Spatial Distribution of Infrastructure: Evidence from California's High-Speed Rail

The Long-Term Economic Impacts of Federal Employment Segregation

Research brief summarizing work by Abhay Aneja and Guo Xu.

Property taxes, wealth inequality, and economic activity: lessons from São Paulo, Brazil

As wealth inequality continues to grow around the world, and as economic activity is increasingly geographically concentrated, there are wide-ranging debates in the economic literature about the role tax policy should play in promoting more equitable distribution of wealth and opportunity. In many rich countries, property taxes represent one of the most prominent tools for raising revenue and incentivizing economic activity in one location versus another. However, since property taxes are rarely used in low- and middle-income countries (LMICs), there is a gap in our understanding of how effectively they might work to affect disparities and economic activity in different contexts.

Brazil offers a unique case study for examining the role property taxes can play in reducing both geographic and racial wealth disparities in an LMIC context. With a robust data infrastructure for researchers to draw upon, and a recent tax reform aimed at creating more equitable distribution of economic activity, the country presents an opportunity to deepen our understanding of how individuals and firms respond to taxation and how taxation on high-value property can act as a tool for redirecting economic activity and promoting greater racial equity. Supported by O-Lab’s Place-Based Policy Initiative, Javier Feinmann, a PhD candidate in Economics, and his collaborators Roberto Hsu Rocha, Davi Moura, and Thiago Scott, are investigating these questions, drawing upon a rich dataset from the city of São Paulo.

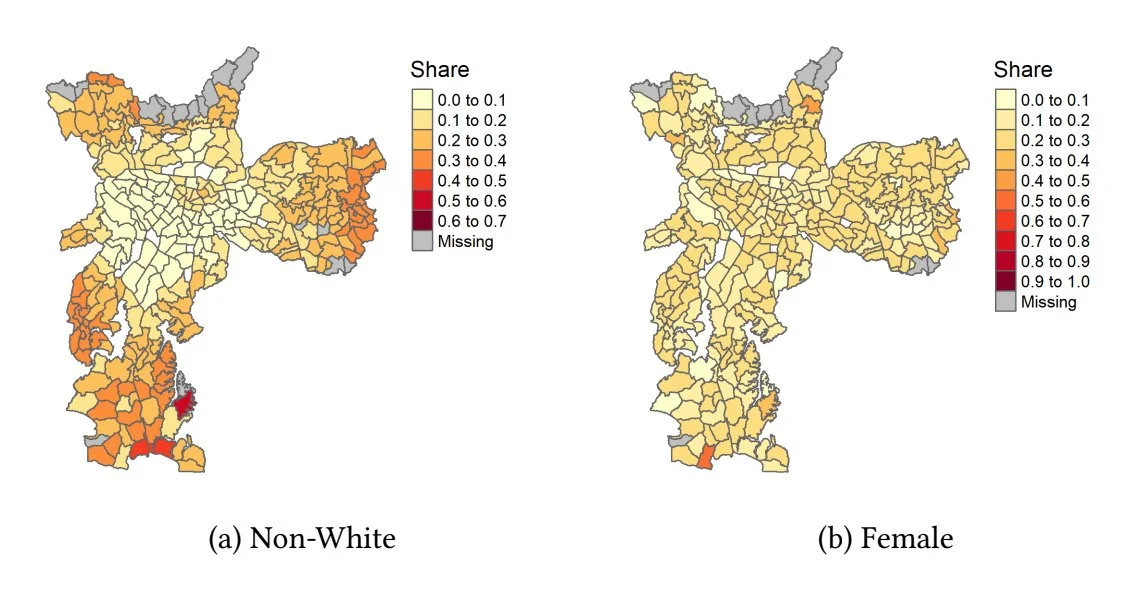

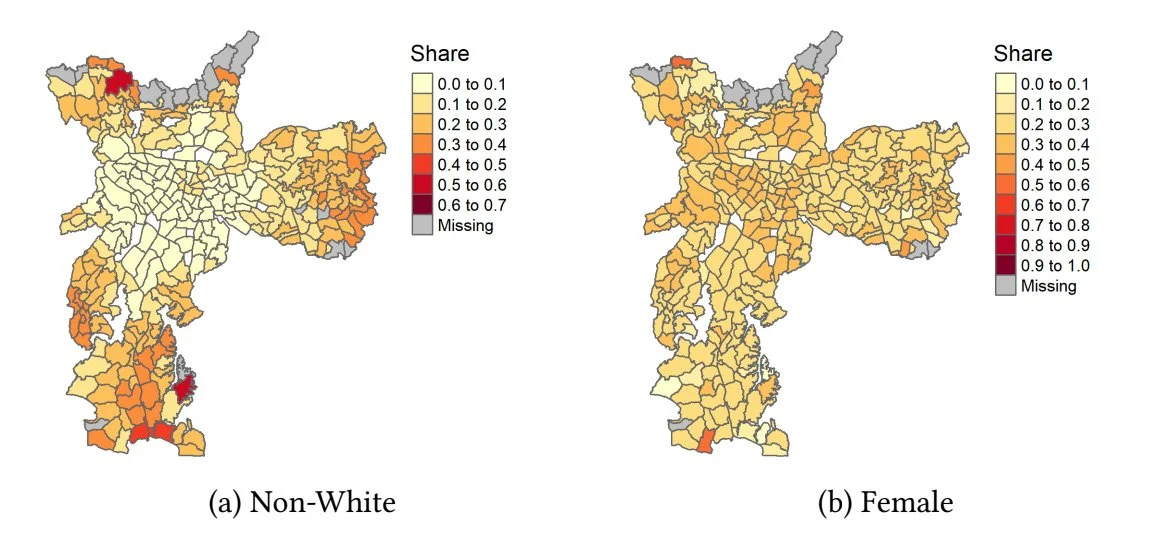

In the first stage of his research, Feinmann and his team are working to understand existing racial and gender disparities in wealth and property ownership in São Paulo. The researchers’ work is supported by a wealth of administrative data that allows him to create highly granular maps of property ownership and property tax rates. The project’s starting point is a database on annual property assessments in São Paulo. Using location-specific property identifiers, the team can spatially plot property values and tax rates throughout the city. Then, using a separate dataset which includes demographic information, they can link these properties to their owners, allowing race and gender identifiers to be incorporated into the map.

Figure 1: Geographical Segregation of São Paulo Property Ownership by Fiscal Zone

Figure 2: Geographical Segregation of São Paulo Wealth by Fiscal Zone

In this descriptive stage of his project, Javier and the team have confirmed disparities in property ownership for women and minority groups. In particular, the researchers find that across all property types and regions of São Paulo, women own fewer properties than men. The team has also found substantial racial disparities in property ownership; however, these are more variable across different regions of the city – likely resulting from existing regional segregation. In general, these gaps in gender and racial ownership are more pronounced among high-value properties.

In the next stage of his project, Feinmann will take a few extra steps to paint a more detailed picture of the distribution of property wealth and tax burdens in São Paulo. Specifically, since the state of São Paulo publicizes the registration of all businesses, Javier and coauthors are able to track the ultimate owners of registered firms that own property in São Paulo, including owner demographics. Then, the property wealth owned by firms can be proportionally assigned to ultimate owners. This novel approach provides a more comprehensive picture of who owns what in São Paulo. By accounting for individuals who own real estate through firms, this project also makes an important contribution to contemporary conversations by economists including Gabriel Zucman and Emmanuel Saez on how to accurately measure wealth held by the top percentiles.

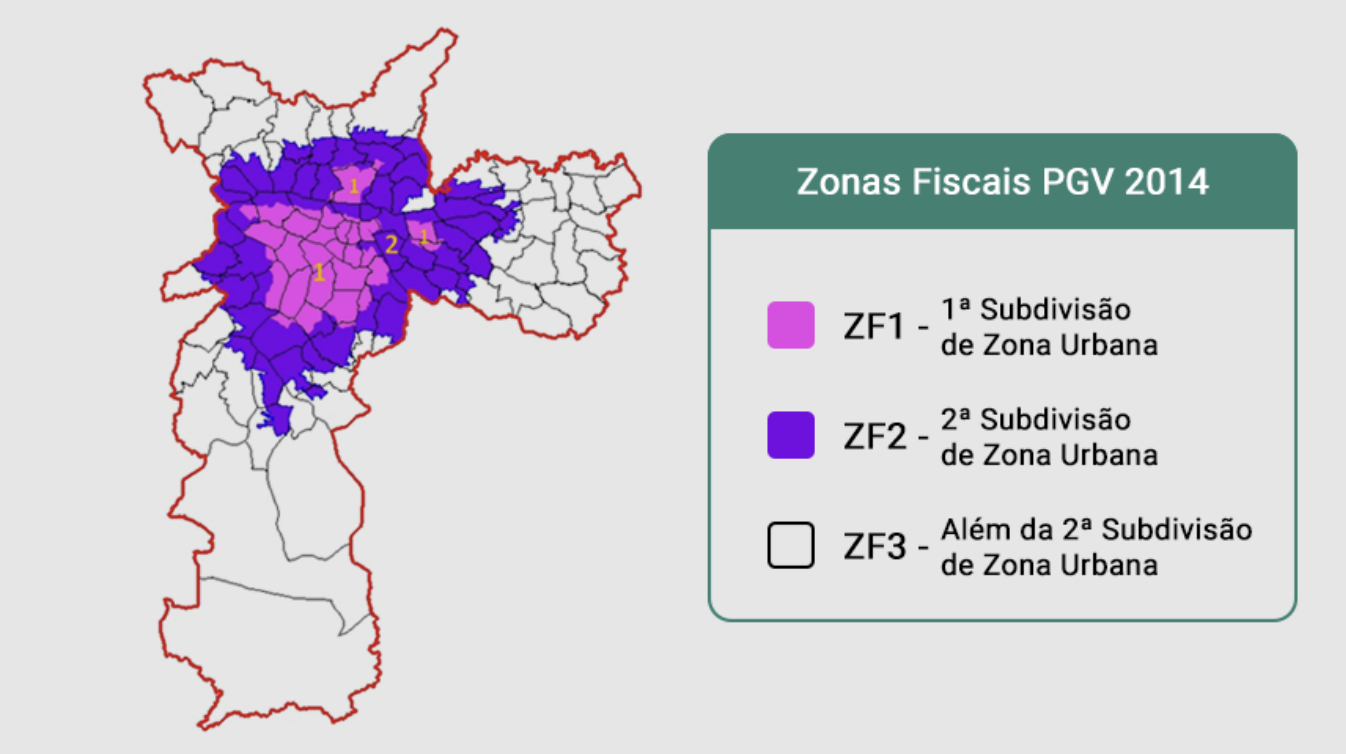

Figure 3: New fiscal zones instated by the 2014 tax reform.

Going forward, the researchers will use their findings as a basis for an analysis of how a major 2014 property tax reform in São Paulo affected economic activity and firm behavior in the city. The law in question divided São Paulo into three separate fiscal zones, and revised the property tax assessment formula to increase taxes on properties closest to the city’s wealthy central district. The intention of this change was to more equitably distribute property tax burdens in São Paulo – was the policy successful? What were the policy’s consequences for the location of economic activity – did it incentivize firm creation in less affluent, low-tax areas, or purely encourage existing firms to relocate? Upcoming stages of this project will explore these questions, and produce important new evidence on how regionally-targeted tax policies can influence racial and gender disparities in property ownership and wealth.

Danny Yagan testifies to Senate Budget Committee

On April 18th, Danny Yagan testified to the Senate Budget Committee. Yagan explained 2 simple ways the wealthy evade taxes, and advocated for raising effective tax rates on the rich through a minimum income tax to increase federal revenues. Watch the full hearing here, or read the testimony.

Mathilde Muñoz in Le Monde

An article from LeMonde highlights the journey of new affiliate Mathilde Muñoz to Berkeley’s economics department, and how her background influences her research. Read more here.

Ziad Obermeyer in NEJM's "Not Otherwise Specified" Podcast

In a recent episode of “Not Otherwise Specified,” a podcast hosted by the New England Journal of Medicine, Ziad Obermeyer explains how machine-learning techniques can aid in establishing a diagnosis and can be a beneficial tool for predictive medicine. Listen to the episode here.

David Card lectures at Emory University

“Minimum wage is one of these super polarizing issues, and with more polarization, it’s become a super symbolic issue.” A recent article in The Emory Wheel recaps David Card’s public talk at Emory University. Read more here.

Michael Reich in Berkeley News

“A minimum wage increase doesn’t kill jobs,” says Michael Reich. A new article from Berkeley News highlights a recent working paper by Reich and coauthors at IRLE on the impact of minimum wage laws on small businesses, which finds that higher wages eases employee recruitment and retention. Read the news piece here, and check out the full working paper.

How does increased minority enfranchisement impact public finance, preferences for public goods, and government fragmentation?

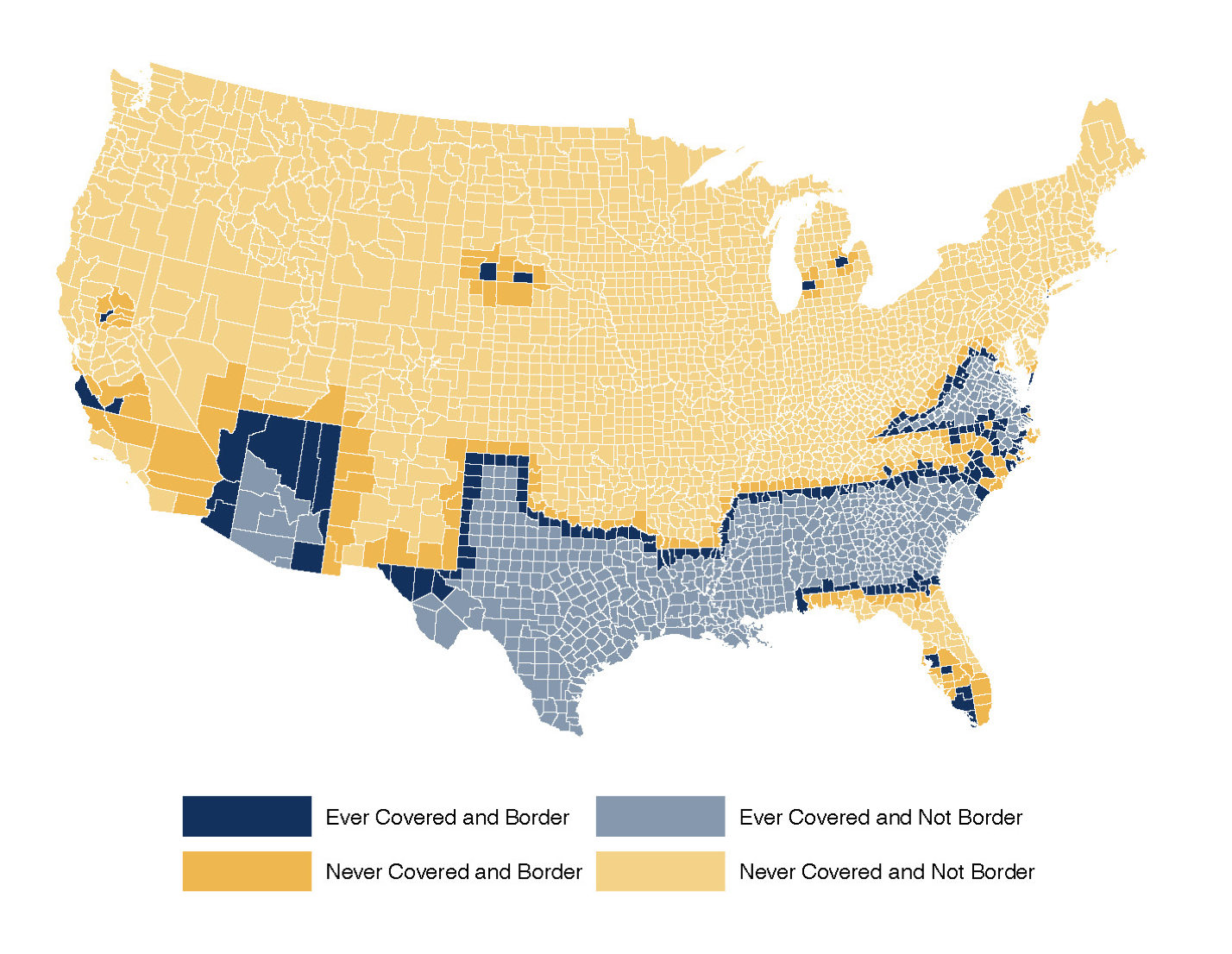

In 2013, the US Supreme Court issued a controversial ruling in the case of Shelby County v Holder, severely limiting the power of the federal government to enforce provisions of the 1965 Voting Rights Act (VRA). Before the ruling, changes to voting regulations by certain state and local governments were required to be “pre-cleared,” or deemed nondiscriminatory, before they were allowed to go into effect; after the ruling, it became the responsibility of disenfranchised voters to advocate for themselves and demonstrate that changes to voting laws were discriminatory.

This landmark ruling inspired a series of new studies examining the historical impacts of the VRA, in an effort to better understand its consequences and forecast the potential impacts of the Shelby decision. Raheem Chaudhry, a PhD candidate at the Goldman School of Public Policy, is leading one such study through his participation in the O-Lab’s Initiative on Racial Equity in the Labor Market.

Raheem’s research focuses on how the VRA impacted local and state revenues, as well as municipal spending on a variety of services and programs – hypothesizing that higher turnout among Black voters would lead to increased spending on public goods. Raheem used data from the Census of Governments, a survey conducted every five years, to get a detailed picture of government spending at all levels, including cities, counties, and special districts. He then compared jurisdictions covered by special provisions of the VRA that applied to only especially discriminatory districts to similar, geographically-adjoined districts, in order to isolate the impact of these parts of the Act. Subsequently, he was able to compare differences in spending in districts impacted to those unaffected.

Initially, Raheem expected to find increases in public spending in those jurisdictions with substantial Black populations that were identified by the VRA as particularly discriminatory (those required to pre-clear any future changes to voting laws). In actuality, he found that counties with larger non-white population shares demonstrated relative declines in government revenues and expenditures — but why? Raheem’s working theory, informed in part by existing literature, sees these changes as a response to increased integration. By ruling out tax base changes as the cause of declining public spending — there were no significant changes in home values or incomes during the period of study — Chaudhry’s work offers a compelling narrative that voters in these districts were less inclined to finance increasingly integrated public resources. Further evidence in support of this theory can be seen in decreased levels of public school enrollment, particularly among white students, from 1968 to 1972 – which suggests that families turned to private school in response to increased integration. Raheem also found relative increases in government fragmentation amongst counties targeted by special provisions of the VRA with larger non-white populations. This finding follows existing literature, and suggests a mechanism by which increasingly integrated counties sought to maintain local control over public finances.

Raheem’s project complements a growing body of work among economists that shows the limits to migration as a tool for surmounting racial income inequality. His work adds an important focus, however, on the role of political power in the success or failure of policies promoting access to resources such as education, transportation, and more. “I think the way that people traditionally think about this is, ‘How do we move kids to high opportunity areas?’ But you can also think about, ‘How do you transform the places kids already live?’ And one way you can do that is through the political process.” While Chaudhry’s project does not find an explicit positive impact of the VRA on local public spending, it nevertheless has important lessons for policymakers. In particular, his work shows the powerful way in which racial backlash can undermine efforts to more equitably allocate public resources.

Conrad Miller on Job Suburbanization & Black Employment

In a National Bureau of Economic Research video feature, Conrad Miller breaks down his paper at the intersection of racial equity, labor, and geography: “When Work Moves: Suburbanization and Black Employment.” Miller finds that highway construction resulted in job suburbanization, increasing the employment gap between black and white workers. Watch the video here.

Ziad Obermeyer on "Me, Myself, and AI"

In a recent episode of “Me, Myself, and AI,” a podcast from MIT’s Sloan School of Management, Ziad Obermeyer discusses his research on algorithmic bias and the use of artificial intelligence and machine learning in predictive analytics in health care. Listen to the episode here.

Research in Review: The Minimum Wage

Emmanuel Saez on State Wealth Taxes

In lieu of a federal wealth tax, state lawmakers in California, New York, and Washington have proposed legislation to tax billionaires on a state level. A recent article from the Washington Post explores these efforts, featuring commentary from Emmaneul Saez, who was enlisted by legislators to help draft the new policies. Check out the full article.

Hilary Hoynes in VoxEU

How does losing access to nutritional support impact families? A VoxEU column highlights research from O-Lab Faculty Director Hilary Hoynes and coauthors on the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC). Researchers find that after losing access to the program, adult women consume less to shield children from nutritional losses. Read the article here.

Enrico Moretti on Tech Hubs

MIT’s Sloan School of Management recently highlighted a new working paper from Enrico Moretti and coauthors that examines the balance between local productivity and local costs in research and development, and finds that the productivity gains from a density of scientific talent generally outweigh the additional costs. Still, their findings suggest that cities with exceptionally high talent density have labor and real estate costs that dwarf gains. Learn more about the study.

Michael Reich on State Minimum Wage Increases

In CNN, Michael Reich discusses recent state minimum wage increases in the context of existing high inflation, suggesting that recent minimum wage increases will not necessarily result in dramatic increases in prices and labor costs in low-wage sectors. Read more here.