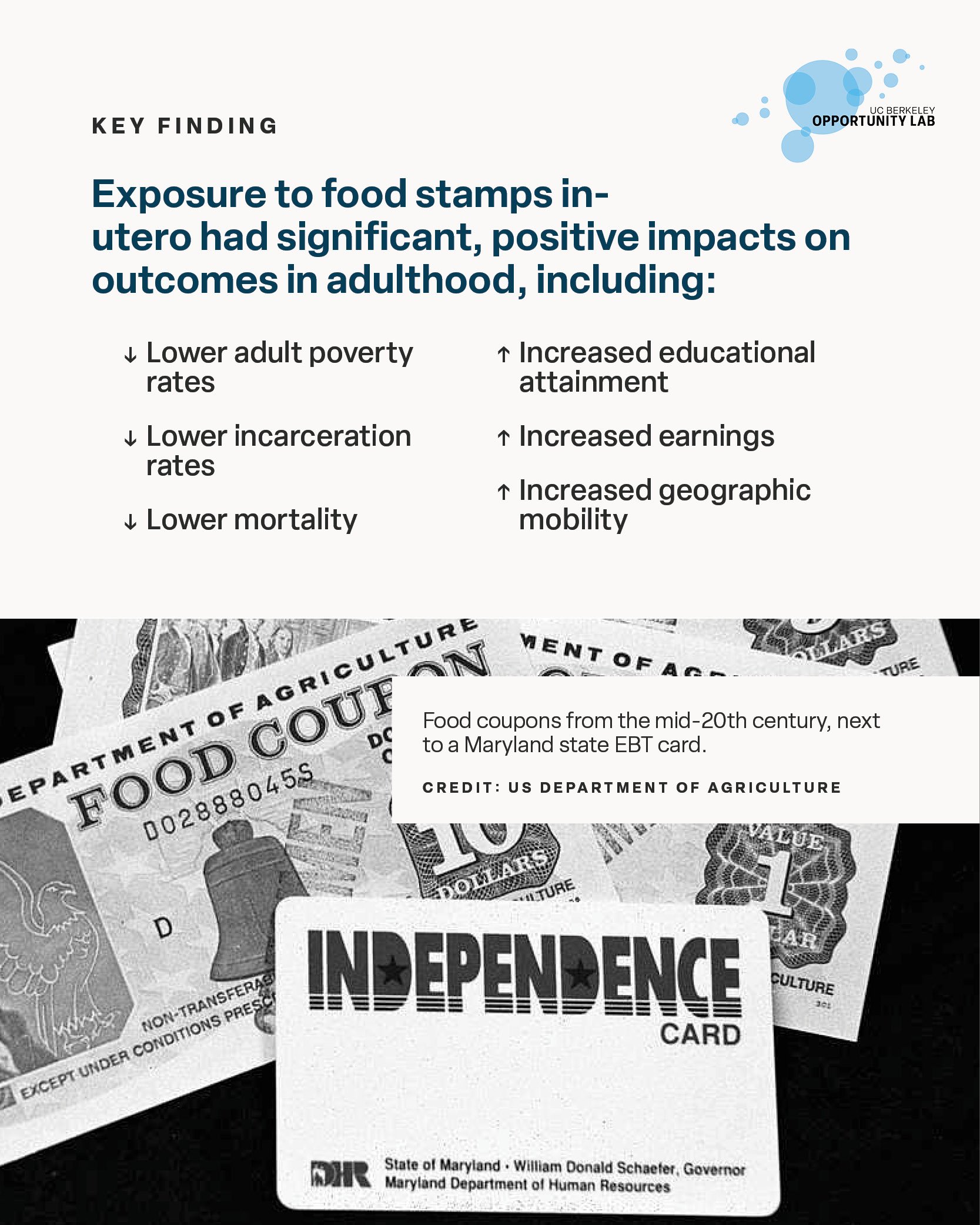

Proposed changes to the US federal budget could entail drastic cuts to vital elements of the social safety net. Given these latest rounds of threats, it's important to reaffirm the many ways in which these programs benefit families—lifting children out of poverty and, in the long run, paying for themselves.

Below, explore key takeaways from research on SNAP — one of the largest anti-poverty programs in the United States.

Check out this video to hear Hilary Hoynes review the evidence on SNAP, as part of an event hosted with the Berkeley Food Institute + Goldman School of Public Policy. Or, read our research brief to learn more about this paper.