In a column from CEPR, Marshall Burke, Solomon Hsiang, and Ted Miguel review literature on the relationship between conflict and climate. The authors highlight that, across contexts, studies consistently point to the social safety net as a tool to mitigate increases in violence induced by climate change by protecting household incomes from climate shocks. Read the full article.

5 Questions for Faculty: Professor Hilary Hoynes

In this installment of the Goldman School of Public Policy’s “Five Questions for Faculty” series, O-Lab Faculty Director Hilary Hoynes, Associate Dean and Chancellor’s Professor of Economics and Public Policy, discusses how the upcoming general election could effect the US social safety net. Read the article here.

New open-source volume on the effects of the 2021 Expanded Child Tax Credit

Newly released in the Annals of The American Academy of Political and Social Science, “Evaluating the Effects of the 2021 Expansion of the Child Tax Credit” brings together some of the strongest research on the 2021 CTC expansion. Edited by O-Lab Faculty Director Hilary Hoynes, Megan Curran of Center on Poverty and Social Policy at Columbia University, and Zachary Parolin, the volume frames the policy change in historical and international contexts, presents the expansion’s near-term impacts, and explores the potential, long-term effects of a permanently expanded credit, in addition to alternative policy designs. Explore the full volume here.

O-Lab Cash Assistance Webinar featured in Spotlight on Poverty

O-Lab’s May 23 webinar on cash assistance for children featured compelling remarks from Senator Michael Bennet, insightful conversations between policy practitioners, and exciting new evidence from researchers on how income support can support socioeconomic well-being for families with children. Check out this feature in Spotlight on Poverty to learn more.

Adam Leive on the effects of work requirements in SNAP

Over the last several years, there has been renewed attention to how the United States promotes economic security for low-income families. During the height of the COVID-19 pandemic, expansions to the Child Tax Credit - combined with direct cash assistance and increased unemployment insurance - demonstrated the powerful capacity of the government to deliver robust support that reduced poverty and protected families’ ability to access food, housing, and other basic needs. The immediate and dramatic impact of those policies have lent additional momentum to efforts to strengthen the safety net by increasing our investments in nutritional support and tax transfers.

While the evidence continues to grow on both the short and long-term benefits of programs like the CTC, the Earned Income Tax Credit (EITC), and the Supplemental Nutrition Assistance Program (SNAP), there is ongoing debate around who is most deserving of accessing the safety net, and how strictly aid should be tied to work.

Adam Leive, Assistant Professor at the Goldman School of Public Policy, has produced valuable evidence to inform the debate around the impact of work requirements in safety net programs. His 2023 paper, “Employed in a SNAP? The Impact of Work Requirements on Program Participation and Labor Supply” evaluated how the introduction of work requirements in Virginia’s SNAP program affected overall recipients’ employment and earnings, as well as how it affected their participation in the program itself.

The team found that the introduction of work requirements for adults 50 and under led to no increases in employment or earnings, but did lead large numbers of people to leave the SNAP program entirely. Leive and his research team also found that homeless populations were disproportionately impacted by the change.

In this O-Lab Q&A, we sat down with Adam Leive, to discuss his findings, the background behind SNAP work requirement policies, his experience collaborating with Virginia’s Department of Social Services, and his perspectives on how research can inform policy.

Source: Social Security Administration

Can you start by talking a bit about the motivation for your study? The question of if (and how much) to make public benefits conditional on work has been around for a long time. Can you give a little background and talk about how this debate has evolved?

To start with the pros and cons, proponents [of work requirements] have been really concerned that providing government assistance ends up discouraging work. So their argument for policies like work requirements is that by incentivizing work, people develop a stronger attachment to the labor market, and then eventually people will earn enough through their job to get by without government assistance.

On the other hand, critics see work requirements as a policy that prevents people who are vulnerable from receiving assistance, ultimately weakening the safety net. So opponents argue that if the reason that people aren't working is something other than the work requirements, then this policy is just going to cut people's benefits without improving their labor market outcomes.

In the US, the safety net has been heavily tied to employment, both incentivizing employment as well as tying benefits to employment. The biggest expansion in terms of work requirements was in 1996 under president Clinton. The official name of that bill was the "Personal Responsibility and Work Opportunity Act," which is better known as welfare reform, and the major change that that bill introduced in terms of work requirements was to make sure that people who are in SNAP who are childless adults and didn't have dependents or disabilities were working for some amount of time in order to receive benefits for more than just a few months.

I think the other thing that's worth mentioning with the '96 reform is that [it] received bipartisan support. Today, work requirements are much more divided, with Democrats largely being against, and Republicans being in favor. In terms of how the debate has evolved, I think there's been a view that some of these conditions can be harmful, and are now something that are not as widely supported the way they were 30 years ago.

What kind of evidence do we have on work requirements, and what new contributions does your study make to this literature?

There's actually been relatively little research on work requirements, when you think about how politically fraught they are. One challenge with looking at the 1996 reform is that so much else changed along with [the work requirements] that it was difficult to tease apart the work requirements from everything else that was going on.

Source: Grey, Leive et al. 2023

There were studies from the Welfare to Work experiments in the 70s and 80s that were really good in that they were randomized controlled trials (RCTs), but they also bundled work requirements with other types of labor market policies, and for the same reasons, also struggled to distinguish the effects of work requirements from some of these other policies.

More recently, and around the same time we wrote our study, there were other studies on SNAP that used different sources of data that also focused on able-bodied adults without dependents, or ABAWDs. These studies tended to find mixed results on participation and labor market outcomes.

Perhaps the best evidence on work requirements comes from Arkansas's experience with Medicaid. One state implemented work requirements in Medicaid for a roughly 9 month period in 2018, and the researchers studied what happened in Arkansas and surrounding states using survey data — they found that the Medicaid work requirements, which were much more onerous than SNAP work requirements, led to large drops in program participation. People also didn't realize what was required to meet them — many people were already meeting them, but just weren't reporting that they were. That experience was a case study of bureaucratic obstacles, as well as the work requirements themselves.

Source: Grey, Leive et al. 2023

Our study examined Virginia - one state - but used detailed administrative data to try to provide a new, focused look on the topic. We took advantage of the fact that work requirements had been suspended during the Great Recession. Like many states, Virginia suspended them and then reintroduced them well after the recovery, in October of 2013. So, we studied what happened before and after work requirements resumed. Importantly, we could study outcomes at the individual level, using administrative records on people's participation in SNAP and their earnings in Virginia. We linked – through a partnership with the Virginia government – these detailed earnings records with SNAP participation records, and that allowed us to see what happened in a world without work requirements and in a world with work requirements.

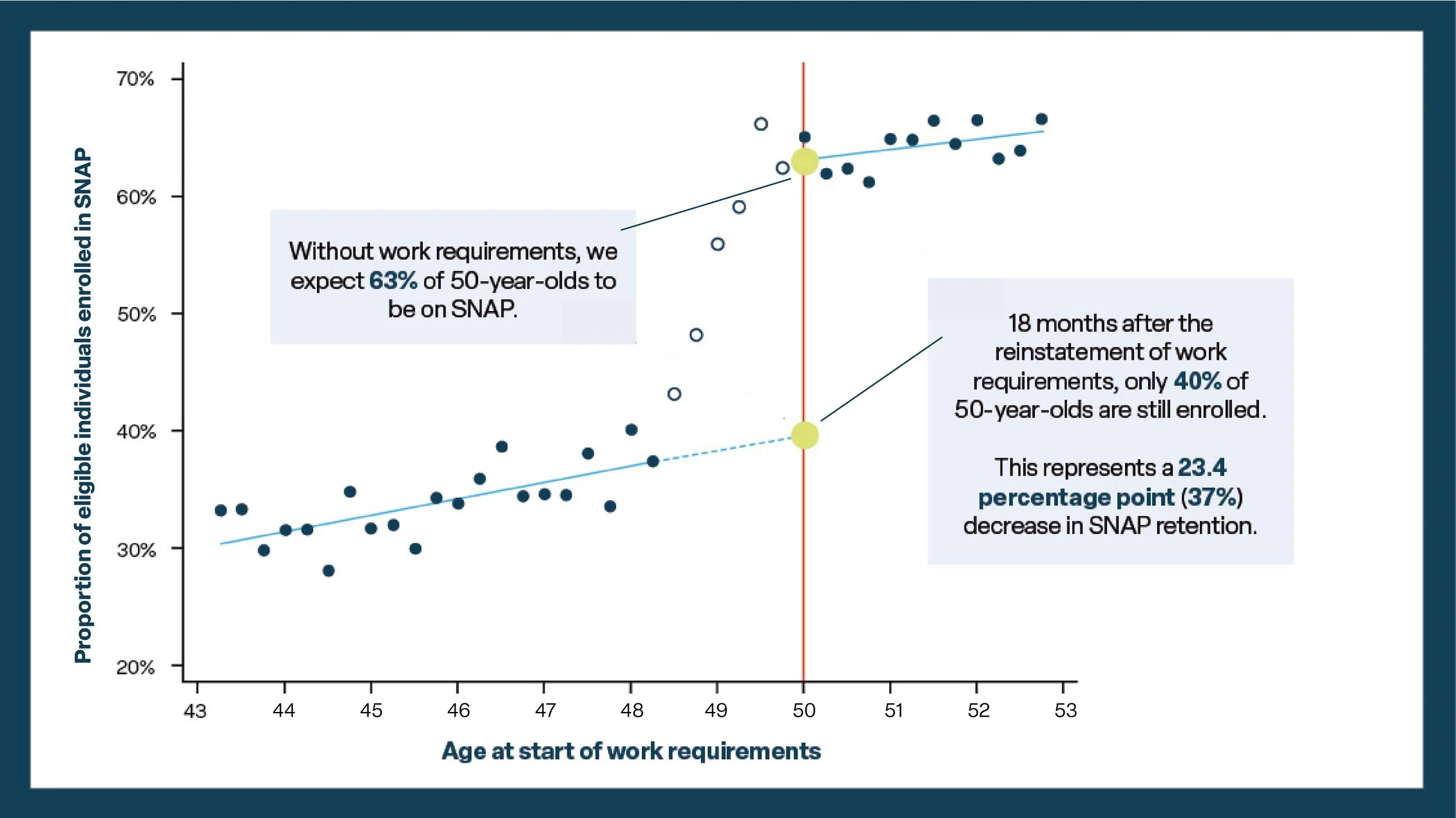

At a high level, what we did is we took advantage of the fact that people under age 50, if they don't have dependents or disabilities, have to meet work requirements, whereas those over age fifty don't. So we compared outcomes for those just below age 50 with those just above age 50. The only difference between these people should be their age when work requirements came back. What we then found was that people just below age 50 had much larger reductions in SNAP participation. We looked at people who were on SNAP after the work requirements resumed, and much higher rates of that group left SNAP compared to those just above age 50 who didn't have to meet work requirements. And yet those large participation declines did not translate into any improvements in earnings or employment on average. So if a major goal of the work requirements is to improve labor market outcomes – we didn't see that. We also found that people who are homeless experience disproportionately large reductions in SNAP participation, so they were especially impacted by the policy.

Effect of work requirements on SNAP retention, 18 months after work requirements

Source: Grey, Leive et al. 2023

This is such a political issue. How do you think about the prospect for your findings to meaningfully inform policy in Virginia or elsewhere? Are there enough legislators who are motivated by research like this?

I wish I knew what politicians were thinking, or motivated by, or how they make decisions. But I do think there's an important role for research in terms of generating evidence that can inform these debates. There are often so many studies out there on any particular topic, but I think a very small number of studies have the potential to influence policy. And the studies that do, I think, are really high quality, often RCTs – if it's not an RCT, it has really compelling evidence. So my focus is generating that kind of research, where there may still be limitations, but it's much more with things like external validity, rather than "I don't believe the study itself," or the internal validity of the research. I see value in trying to produce those types of studies that can have an impact, and the way that I try to go about doing so is by testing some main theory or some motivation, for these work requirements. But often what the research does is rule out some explanations, rather than to “rule in” a particular explanation – that's what the social sciences are well equipped to do.

So what we've done is say, "Okay, work requirements don't lead to large improvements in employment or earnings. We can feel pretty confident statistically about this, for this population." If we saw a big improvement in employment and a decline in participation, that would arguably be seen as a good thing, or at least it would be consistent with the intent of the policy. So our results indirectly suggest that maybe there are other barriers people are facing. For example, people don't have a stable job that offers hours that don't fluctuate. Other people might have challenges getting transportation to a job. What our study would point to is that looking at those barriers may be important for future work.

Another motivation that is sometimes discussed is that imposing some kind of hurdle can be efficient from an economic perspective, because only the people who need benefits the most will go through the hassles of overcoming those hurdles. So if the government has a limited amount of resources to provide as part of safety net benefits, then these hurdles can perhaps better target assistance by getting people to self-select into the policy. That has been more of a theoretical point that some economists began making in research decades ago. And our results that homeless people are disproportionately screened out, I would say, is strong evidence against that theory. If the most vulnerable people face a higher cost to overcoming these barriers, even if they have higher benefits from the safety net, they might be screened out.

Your paper finds that the reestablishment of work requirements in Virginia disproportionately caused homeless individuals to leave the program. What role does SNAP play in supporting homeless people, and in what direction should safety net debates shift in light of the homelessness crisis?

Homeless people are some of the most vulnerable people in society, and SNAP and other safety net programs can provide lifelines for them. So I think efforts to make it easier for people who are eligible to receive and maintain their benefits are extremely important. I'm not an expert in this particular aspect of SNAP, but I think that making sure that information is communicated via different modalities, like alternatives to mailing addresses, can be important, especially when benefits require a lot of reporting from the client side. In terms of the mechanics of benefit calculations, there's a shelter deduction for people without stable housing that can allow them to increase their benefits, and that's important for people who have some income. People who don't have any income are getting the max benefit, but many homeless people are working, so shelter deductions can help increase those benefits.

Taking a step back on this issue of homelessness, safety net policies that provide assistance for healthcare, for utilities, for rent can be important for preventing homelessness, but those deal with the problems caused by a lack of affordable housing. So ultimately, I really think the issue is much more about increasing the supply of affordable housing as the crucial policy lever. SNAP and the safety net are very important, but we should also be focused on making upstream investments in increasing housing supply.

Virginia State Capitol building. Source: faungg via Flickr.

How would you describe your experience working with the Virginia state government? How did the collaboration arise? Has the partnership offered any insights into working with governments that might be useful for researchers conducting similar work?

Overall, it's been an absolutely fantastic experience. Before coming to Berkeley, I spent 6 years at The University of Virginia’s Public Policy School and I wanted to produce research on topics relevant to the local community and the state. I'm very lucky to have great partners in Virginia – and as someone who's in a policy school, it's kind of a dream come true. You get to work with government collaborators to study a question that they're interested in answering using tools that you have specialized training in. I was very fortunate that my counterparts in Virginia were people who understood research and its value, and were interested in results regardless of what the outcome was, and who also had the training to be able to articulate why certain data was necessary. There were a lot of “asks” that had to be made in terms of trying to get more information from various government officials, or understand certain parts of a program. To have partners who have themselves been involved in research, many of whom have PhDs, is really helpful because they can advocate for the importance of research, as there can understandably be skepticism about an outside scholar coming in to study a program. I think what you learn is the importance of finding someone who has the decision-making power to say yes, in terms of helping you get the access you need to do the study, and who's genuinely interested in the answer, regardless of what it is.

Do you have any plans to examine how work requirements affect people in the long term? If not, what avenues could you expect other researchers to take?

I'm continuing to collaborate with Virginia's Department of Social Services to help them design ways that the program can best support the SNAP population, and simultaneously improve economic outcomes for recipients. Some outcomes that I think are important to look at in the context of work requirements, that we don't know much about, are food insecurity and health, the most fundamental aspect of what SNAP is supposed to be about. Taking a broader lens, on the benefits side, I think it's possible that some of the effects on health might be very important for long-term outcomes.

Lessons From The 2021 Child Tax Credit Expansion Informing State Policy Debates

Blog post in collaboration with The Urban Institute, summarizing key takeaways from O-Lab’s convening on Enhancing Child Well-Being with Cash Assistance.

Hilary Hoynes on the Expanded Child Tax Credit in The Hill

Programs dedicated to alleviating child poverty have been shown to generate powerful social and economic benefits - in educational performance, income, and health outcomes - over a lifetime. Take a look at this important perspective from Faculty Director Hilary Hoynes and Rita Hamad in The Hill.

Research in Review: The Minimum Wage

Hilary Hoynes and Reed Walker on the Future of Family

Hilary Hoynes and Reed Walker were recently cited in a New York Times op-ed by Paul Krugman on the importance of the Biden administration’s new support for child care and education. Among the cited work was Hoynes’ research on SNAP benefits and other safety net investments in children.

Perspectives on the Impact of the Expanded Child Tax Credit and the Development of a New Research Agenda on Child and Family Economic Well-Being

O-Lab Program Manager Joe Broadus, Faculty Director Hilary Hoynes, and colleagues at the Urban Institute share key takeaways from a convening gathering stakeholder input on a new research agenda on child and family economic well-being.

Hilary Hoynes on the Impact of the Expanded Social Safety Net

A recent New York Times article by Jason DeParle analyzes how recently expanded social safety net programs have powerfully reduced child poverty. DeParle features commentary from Hilary Hoynes, who insists, “When we spend money, we make gains,” she said. “Providing more resources to low-income families changes children’s life trajectories.” Read the article here.

The Power of Pre-K

Research brief summarizing work by O-Lab affiliate Christopher Walters (UC Berkeley), Guthrie Gray-Lobe (University of Chicago), and Parag Pathak (MIT).

Michael Reich on the California Living Wage Act

A new Opinion piece published in the Los Angeles Times cites research from affiliate Michael Reich on the California Living Wage Act to substantiate calls for a minimum wage increase. Reich found that the Act would have a negligible contribution to inflation – but as the measure failed to qualify for the 2022 ballot, LA Times author Isaac Lozano suggests a wage increase is in the hands of the state legislature. Read the article here.

Hilary Hoynes testifies to the House Budget Committee

O-Lab Director Hilary Hoynes testifies to the House Budget Committee, reviewing research that shows safety net programs for children are cost-effective investments with long-term impacts on children’s life outcomes. Read the report and watch the hearing here.

Hilary Hoynes on Investing in Children

A new New York Times Opinion piece by Bryce Covert argues that the United States should do more to keep young people out of poverty through expanded social programs. O-Lab Faculty Director Hilary Hoynes notes that, compared to other countries, the United States spends far less money on reducing its child poverty rate – despite the proven success of programs that target poverty among the elderly, like Social Security. Read more here.

David Card Awarded Nobel Prize in Economics

On October 11th, David Card was awarded the 2021 Nobel Prize in Economics along with Joshua Angrist and Guido Imbens. Card has pushed the boundaries of the field of labor economics for over three decades, including his landmark 1993 paper with Alan Krueger on a New Jersey minimum wage increase.

Read more about the award and read his 1993 paper here.

Hilary Hoynes on the Benefits of Anti-Poverty Programs

Hilary Hoynes was recently featured in a NY Times article by Paul Krugman for her research on the impact of America’s anti-poverty programs on children living in poverty. Her findings showed that “unlike tax cuts for the rich, aid to poor children would largely pay for itself” purely in fiscal benefits alone, on top of the educational and health benefits these programs offer. To learn more, check out full article here.

Do Financial Concerns Make Workers Less Productive?

Research brief summarizing work by Supreet Kaur, Sendhil Mullainathan, Suanna Oh, and Frank Schilbach.

Hilary Hoynes on What the Expanded Child Tax Credit Means for American Families

Hilary Hoynes recently co-authored an article in Quartz on how the Biden administration’s expanded child tax credit will lift millions of children out of poverty. Hoynes also discusses research surrounding other long-term benefits of the program, including improved health and educational outcomes.

Jesse Rothstein on why people are dropping unemployment benefits before they run out

Jesse Rothstein recently appeared on NPR’s Marketplace podcast explaining why a large number of people with pandemic unemployment benefits were choosing to take up employment before their benefits ran out.